jefferson parish property tax assessment

Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. This property includes all real estate all business movable property personal property and all oil gas property and equipment.

Just Enter Your Zip for Free Instant Results.

. Property tax bills may be remitted via mail hand-delivery or paid online at our website. The assessment date is the first day of January of each year. Education recreation and other functions of parish government.

Payments are processed immediately but may not be reflected for up to 5 business days. Other personal property is depreciated according to guidelines set by the state of Louisiana. Homestead Exemption Deduction if applicable-7500.

If your homesteadmortgage company usually pays your property taxes please forward the tax notice to them for payment. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website. - Homestead Exemption Information for residents of Jefferson Parish Tax Estimate - How to calculate your property tax Seniors Special Assessment - Important information for.

Property Tax Calculation Sample. Box 863 Jennings Louisiana 70546. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Jefferson Parish LAT-5 forms are due 45 days after receipt. Market Value 200000. Welcome to the Jefferson Parish Assessors office.

A convenience fee of 249 is assessed for credit card payments. The convenience fee amount is displayed at the top of the Payment Information page once a credit card is selected and is listed under Payment Amount. Property Maintenance Zoning Quality of Life.

The Jefferson Parish Assessors Office determines the taxable assessment of property. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Property taxes for 2020 become due upon receipt of the tax notice.

Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill. Inventory is assessed at 15 of the monthly average. If not property taxes may be paid through several other methods.

Jefferson Parish Assessors Office Jefferson Parish Assessor. The Jefferson Parish Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Jefferson Parish. Contact Us Services Calendar News Jobs.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes. The total number of parcels both commercial and residential is 185245.

The Jefferson Parish Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. All corrections to a tax statement must be made through the. Ad A Comprehensive Property Tax Search Just Takes 12 Minutes.

Get In-Depth Property Tax Data In Minutes. Lopinto III as the Ex-Officio Tax Collector of Jefferson Parish will begin printing the 2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. The median property tax on a 17510000 house is 31518 in Louisiana.

Jefferson Parish Permits 400 Maple Avenue Harvey LA 70058 504-364-3512 Directions. The preliminary roll is subject to change. Property values are assessed through the Jefferson Parish Assessors Office.

Ad Just Enter your Zip Code for Property Tax Records in your Area. When and how is my Personal Property assessed and calculated. Jefferson Parish property tax bills for 2017 began hitting the mail Friday Nov.

Start Your Homeowner Search Today. Its duties also include organizing and directing annual tax sales. Enter the Address to Begin.

Jefferson Davis Parish Sheriffs Office. Jefferson Parish Permits 3300 Metairie Road Metairie LA 70001 504-832-2399 Directions. No convenience fees are assessed for.

Easily Find Property Tax Records Online. As of September 24 the Orleans Parish Assessor announced a 5 reduction on all residential property taxes. Expert Results for Free.

Online Property Tax System. Cashiers Checks money orders or personal checks should be made out to. The Property Tax Divisions primary function is to collect property taxes on real estate and moveable property based on the assessed value as determined by the Jefferson Parish Assessors Office.

If you have a question about taxes owed or concerns about your tax statement please contact the Sheriffs Office at 337-821-2120. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jefferson Parish Tax Appraisers office. Get Property Records from 8 Building Departments in Jefferson Parish LA.

This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that pertain to the Assessors office. Jefferson Parish Property. The Jefferson Parish Assessors Office determines the taxable assessment of property.

Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. The AcreValue Jefferson Parish LA plat map sourced from the Jefferson Parish LA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Search Any Address 2.

Jefferson Parish Assessors Office - Property Search. Read Local County Assessor Records to See the Propertys Assessed Value. Millage Rate for this example we use the 2018 millage rate for Ward 82 the Metairie area x11340.

Here is how the program works what other parishes are providing relief and what to do. The median property tax on a 17510000 house is 75293 in Jefferson Parish. The role of the Clerk of Court in each parish is to maintain and preserve the official records of the parish.

The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. Taxed Value 12500. Jefferson Parish Permits 822 South Clearview Parkway Elmwood LA 70123 504-736-7345 Directions.

See Property Records Tax Titles Owner Info More. Assessed value is the Taxed value if no Homestead Exemption is in place. Its Fast Easy.

17 with Sheriff Joe Lopinto the ex officio tax collector saying the total number being sent is 175583. Not all municipalities have tax records online or have the ability to pay taxes online. Assessed Value 20000.

/cloudfront-us-east-1.images.arcpublishing.com/gray/Y56PAWKNTJCPZERNM6GMEO4NKI.jpg)

April 30 Election What S On Your Ballot

Payments Jefferson Parish Sheriff La Official Website

Hurricane News And Information

Hurricane News And Information

Hurricane News And Information

Jefferson Parish Voters Set To Decide On Millage Increase To Fund Sheriff S Office Hiring Raises

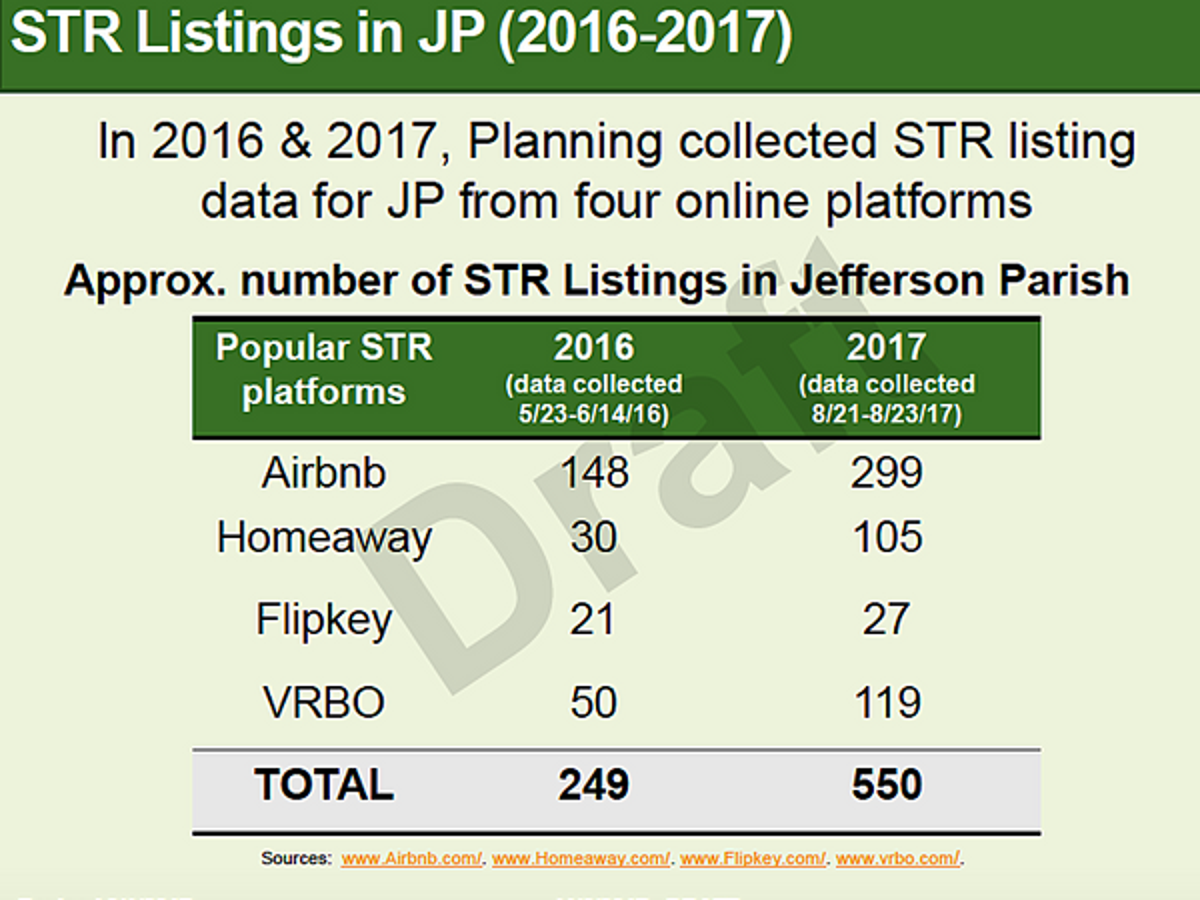

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

What Jp Residents Need To Know To Pay Property Tax

E Services Jefferson Parish Sheriff La Official Website

Payments Jefferson Parish Sheriff La Official Website

Faqs Jefferson Parish Sheriff S Office La Civicengage

St Tammany Parish Sheriff 007 Sheriff Office Sheriff Parish

Jefferson Parish Property Owners Will Pay More Taxes Soon Here S Why Local Politics Nola Com